South East England

B&H Blue

Sovereign Blue

Sterling

Rothmans Value

JPS Players

Amber Leaf

Gold Leaf RYO

Sterling RYO

Golden Virginia Original

Golden Virginia Yellow

Midlands

B&H Blue

Sterling

JPS Players

Carlton

Sovereign Blue

Amber Leaf

Sterling RYO

Gold Leaf RYO

Golden Virginia Original

Golden Virginia Yellow

Wales

JPS Players

L&B Blue

Carlton

Sterling

L&B Original

Amber Leaf

Sterling RYO

Gold Leaf RYO

Golden Virginia Original

Lambert & Butler RYO

Scotland

JPS Players

L&B Blue

L&B Original

Sterling RYO

Kensitas Club

Amber Leaf

Gold Leaf RYO

Golden Virginia Original

Sterling RYO

Lambert & Butler RYO

North England

JPS Players

L&B Blue

L&B Original

Sterling

JPS Silver Range

Amber Leaf

Gold Leaf RYO

Sterling RYO

Golden Virginia Original

Lambert & Butler RYO

South West England

JPS Players

B&H Blue

Rothmans Value

Sterling

Carlton

Gold Leaf RYO

Amber Leaf

Golden Virginia Original

Cutters Choice Extra Fine

Cutters Choice

Greater London

B&H Blue

Marlboro

Sovereign Blue

Sterling

Embassy Signature

Amber Leaf

Sterling RYO

Golden Virginia Original

Gold Leaf

Golden Virginia Yellow

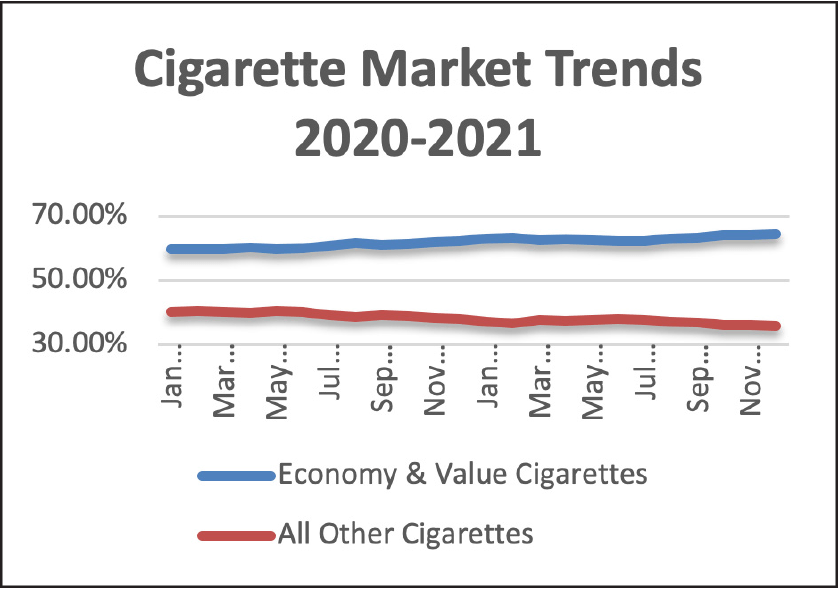

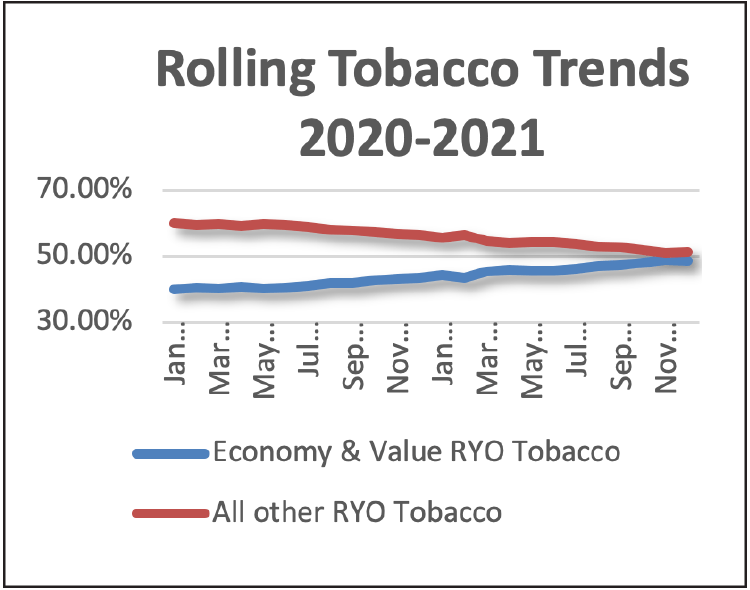

- As prices rise, primarily driven by duty increases, consumers continue to trade down to lower price brands in both cigarettes and RYO.

- Therefore it is more important than ever to sell the cheapest brands at RRP to protect your tobacco sales and footfall into your store.

Top Selling value brands are:

Cigarettes

RYO

Source: UK EPOS to w/e 02/01/22