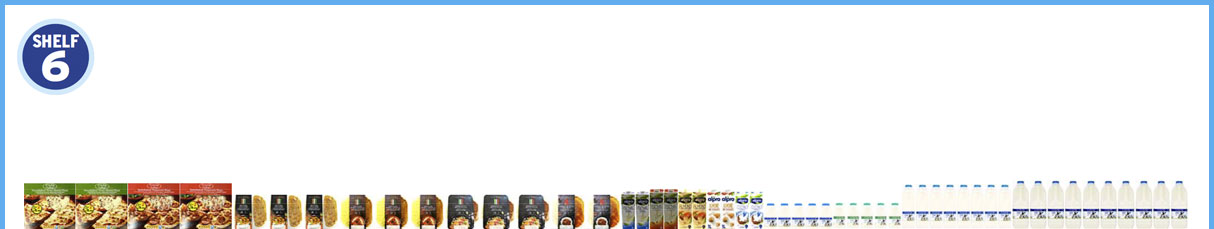

It's important to represent all fat types and core pack sizes (1L/2pt & 2L/4pt)

Category advice

Market Insight

Category advice2023

Cheese

Excluding milk, Cheese is the largest chilled dairy category in convenience stores, worth £94.5m.

Cheese is bought by 3 in 10 households on average every 4.5 weeks in convenience stores.

Flavoured Milks/Rtd Coffees

Flavoured milk and RTD coffees are worth £124m in Symbols and Independents and growing by 19.5% vs LY, Total Convenience sales were worth £252m in 2022 with sales +23%.

Chilled Coffee continues to outperform the Soft Drinks category and deliver double digit growth in the L52Wks: Value +18.3% vs. (Total Soft Drinks +10.2%). This growth is even faster within Symbols (+32.7% YoY).

Chilled Yoghurts

A convenience shopper who picks up Chilled yoghurts and Desserts when in store has an average basket value of £18.06, this is an increase of 71% on the average convenience basket spend.

Category Overview

Chilled space is precious in convenience stores, making it vital to get the basics right. A customer that can find the basics whenever they shop is likely to visit at least 3 times more each month and increase basket spend by between 25 & 140%.

Milk

Milk is the largest category at £407m, accounting for 55% of sales and growing at +4.3% YoY.

Non-dairy Milk

Plant-based drinks hold 3% share of the milk category in independents & symbols. If stores stock one Non-Dairy milk it should be an Oat based one as these account for 51% of sales and were the fastest growing segment in 2022 (+37%).

Butter and spreads

3 in 10 households have bought butters & spreads in a convenience store in the last year. Stocking brand are key as they deliver 95% of value sales and 90% of category volume sales in C-stores.

Chilled Juice

Within symbols and indies, the Chilled Juice category is worth £26m. Take home Juice is the largest part of this with 65% share vs 35% for Single Serve Juice.

Chilled Meat Snacking

Chilled Meat Snacks are worth over £236m and are growing +17%.

Chilled Meat Snacking is growing +25% in total convenience.

The Micro-snacking category is worth £32.1m the Impulse channel growing at 3.0%.

Milk

- If stores stock one Non-Dairy milk it should be an Oat based one as these account for 51% of sales and were the fastest growing segment in 2022 (+37%). After Oat, Soya is the second biggest segment with a 26% share and then Almond with a 17% share.

Chilled Juice

- Single serve juice under trades in Symbols and Indies by 22% points vs the total impulse channel – huge opportunity to close this gap – shoppers are increasingly choosing juice and smoothies for a healthy snack.

Cheese

It is crucial to stock Cheddar as it delivers 47% of Cheese volume sales.

- Hybrid working is now the norm, stock a range of cheese snacks to cater for both in home and carried out lunch occasions targeted at both kids and adults.

- Consumer focus on health has grown following the pandemic. Meet shopper needs by offering reduced fat and dairy free alternatives from the top selling brands.

Flavoured Milks/Rtd Coffees

- Where possible site single serve drinks at front of store and close to other soft drinks. Including Flavoured Milks in lunch Meal Deals (as many of the Supermarkets do), this is also a great way to drive shopper spend and repeat visits.

- Flavoured Milks are particularly strong in Convenience where they have outperformed Total Market growth in 2021 and 2022 at +6%, this is a category that retailers should be backing and giving more space to.

Retailers should also make sure that they offer shopper both on the go and take-home solutions.

Butters & Spreads

- Top selling 10 sku's generate 61% of convenience store category value sales.

- Catering for all shopper needs within the range is key to capitalise on the planned top up mission. Demand is strong for Dairy Free so ensure this segment is represented on shelf.

PMPs should be stocked where possible.

Information correct at time of print.

Must Stock Lines

Category advice2023

These are the ‘Must Stock’ lines which shoppers expect to see in a convenience store. By stocking these lines, you will be meeting your customers’ needs and therefore they will visit your store again.

We suggest you stock the following range:

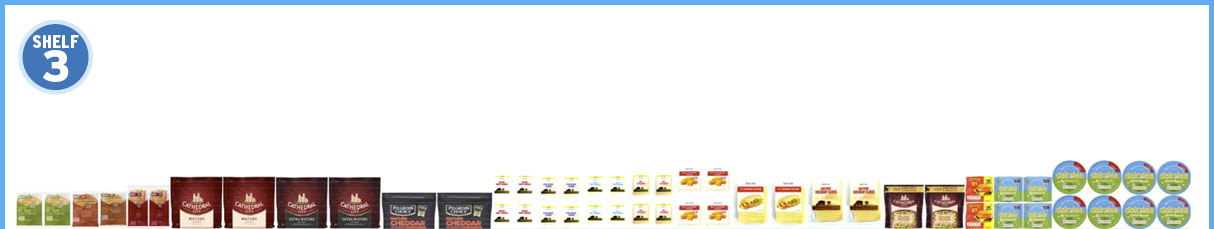

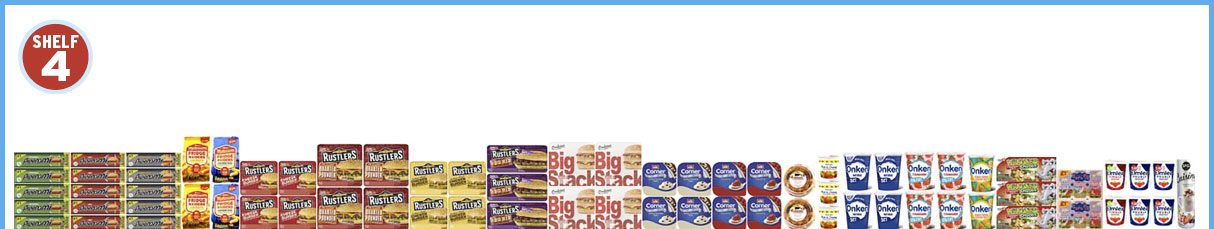

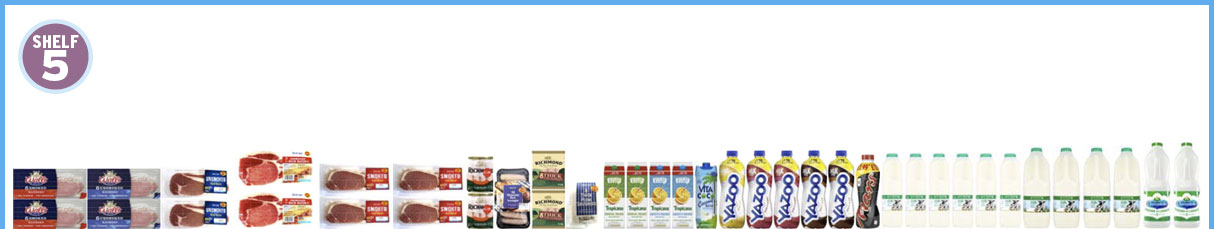

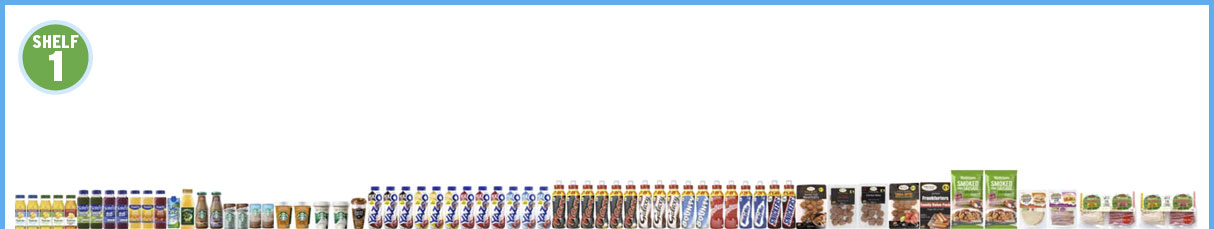

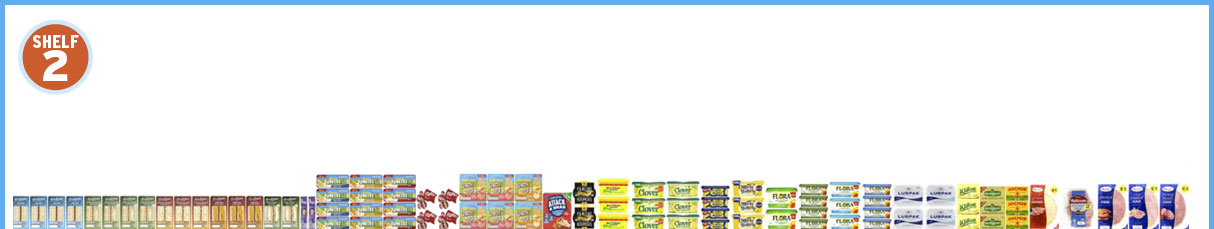

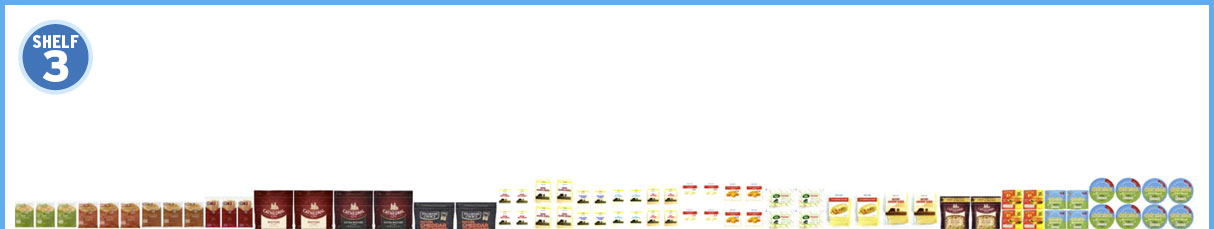

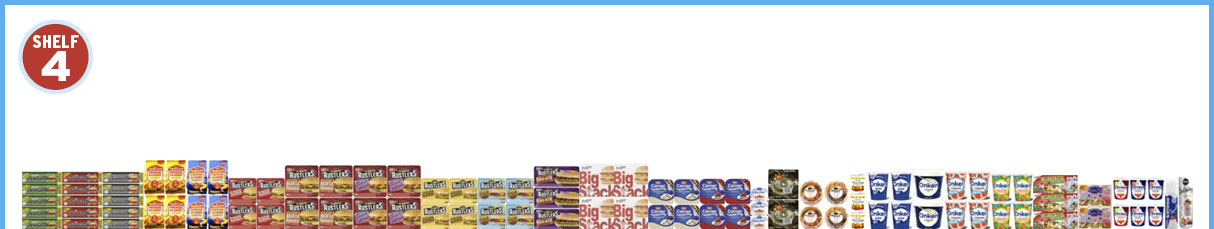

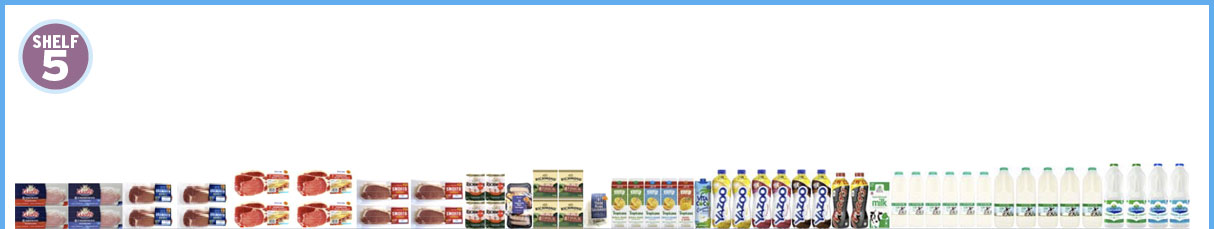

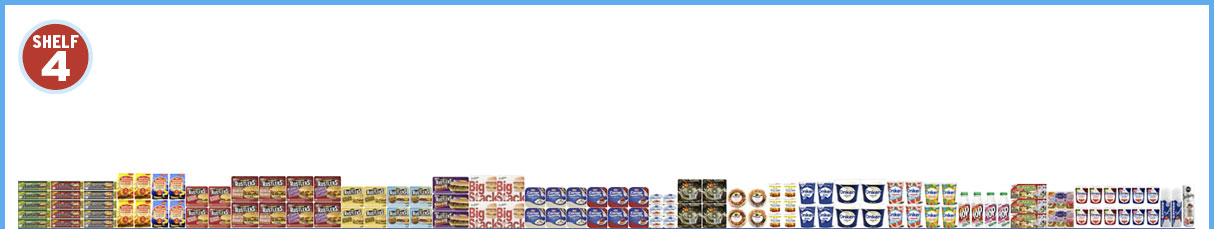

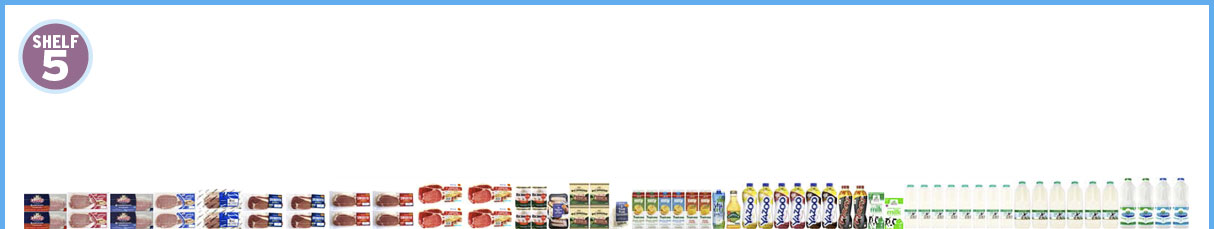

Planograms

Category advice2023

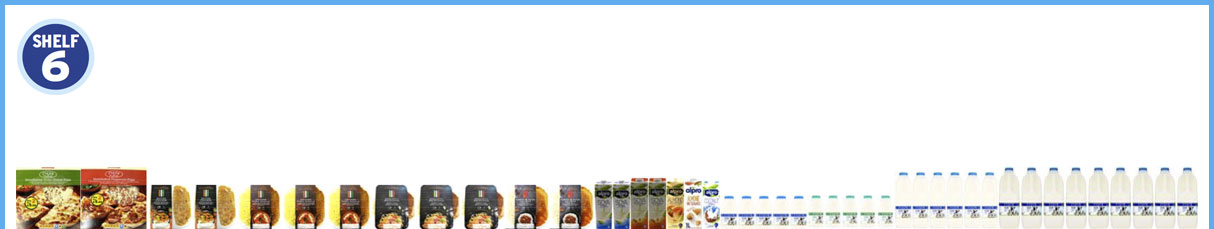

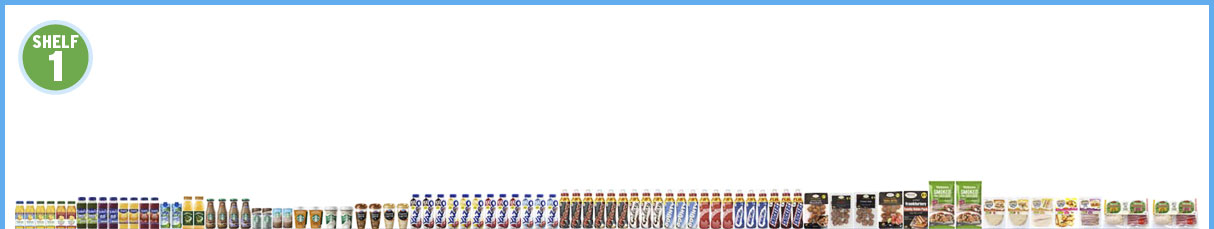

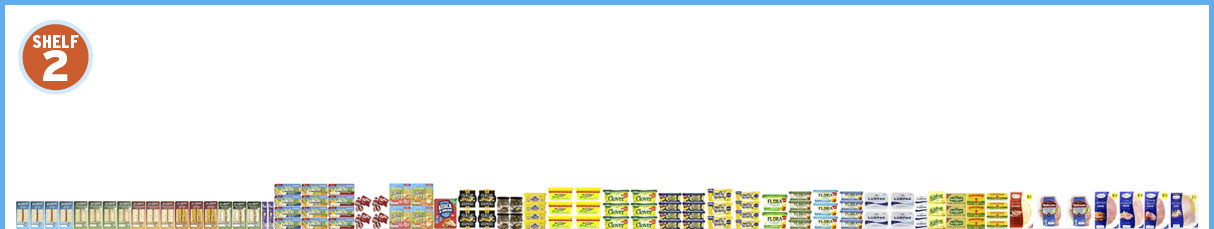

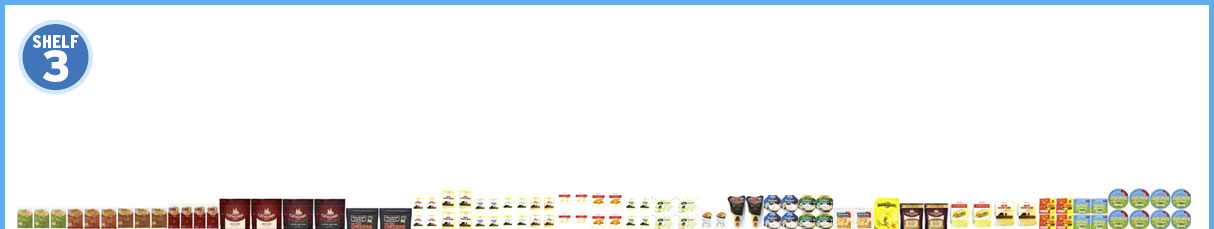

1.25m

6

Shelfplanogram

view

2.5m

6

Shelfplanogram

view

3.75m

6

Shelfplanogram

view

5m

6

Shelfplanogram

view

6.25m

6

Shelfplanogram

view

We suggest you stock the following range:

Click shelf to hide/show shelf product list

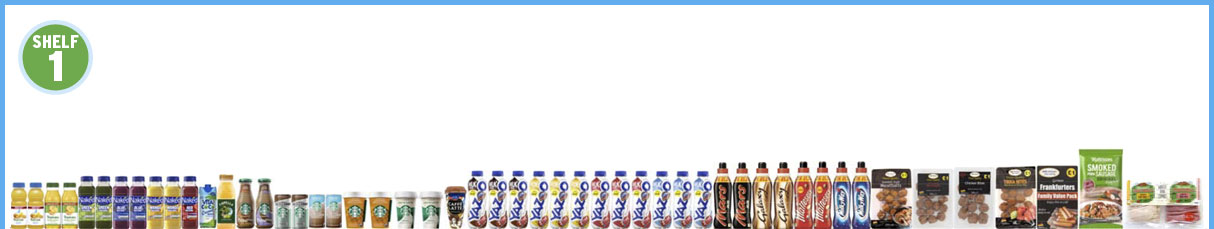

Starbucks Frappucino Coffee 250ml Starbucks Frappucino Coffee Mocha 250ml Starbucks Double Shot 200ml Yazoo Milk Chocolate Caramel PM £1.15 400ml Yazoo Milk Chocolate PM £1.15 400ml Yazoo Milk Strawberry PM £1.15 400ml

Yazoo Milk Vanilla PM £1.15 400ml Yazoo Milk Banana PM £1.79 1ltr Yazoo Milk Chocolate PM £1.79 1ltr Yazoo Milk Strawberry PM £1.79 1ltr Delamere Chocolate Milk 500ml Delamere Strawberry Milk 500ml

Mars PM £1.29 350ml Tropicana Orange Juice Smooth PM £1 250ml Tropicana Smooth PM £2.75 850ml Best-one Orange Juice 2 For £2 1ltr Best-one Apple Juice PM 2 For £2 1ltr

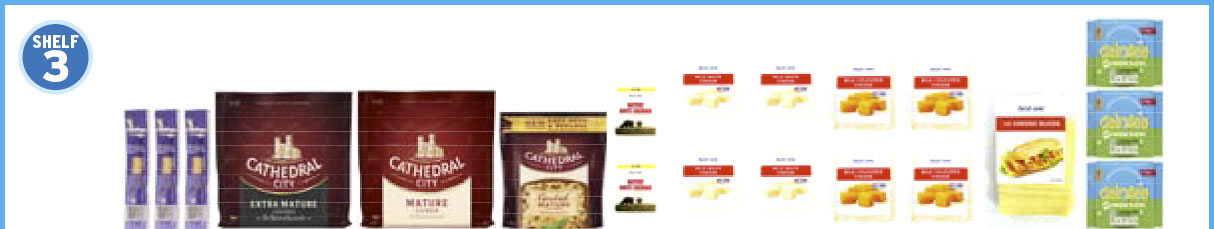

Cheesestrings PM 45p 20g Cathedral City Extra Mature 200g Cathedral City Mature 200g

Cathedral City Grated Mature Cheddar 180g Best-one Mature White Cheddar PM £1.99 200g Best-one Mild White Cheddar PM £1.29 150g

Best-one Mild Coloured Cheddar PM £1.2 150g Best-one Cheese Slices 200g Dairylea Slices PM £1.70 164g

Snaz On The Go Sausage Roll PM £1.29 130g Peperami PM £1 28g Rustlers Flame Grilled Cheeseburger PM £1.40 141g

Onken Natural Set Bio Yogurt 500g Best-one Rich Creamy Yoghurt PM 55p 150g Onken Fat Free Strawberry 0% Fat 450g

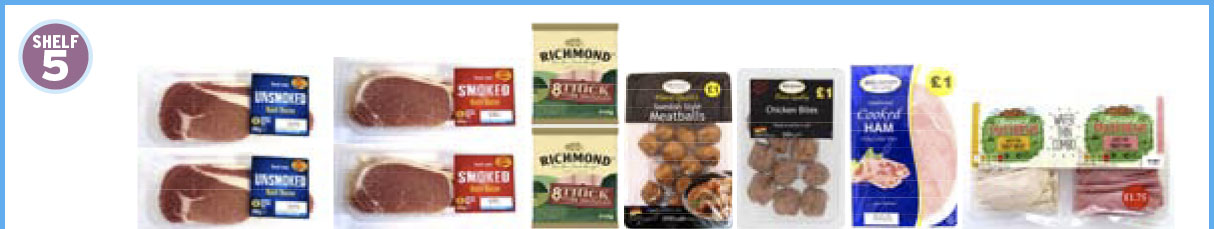

Best-one Unsmoked Back Bacon PM £1.79 200g Best-one Smoked Back Bacon PM £1.79 200g Richmond Thick Sausage 8's 410g

Delicatessan Fine Eating Swedish Meatballs PM £1 200g Delicatessan Fine Eating Chicken Bites PM £1 200g

Dfe Cooked Ham PM £1 90g Bernard Matthews Wafer Thin Turkey & Ham 280g

We suggest you stock the following range:

Click shelf to hide/show shelf product list

Starbucks Frappucino Coffee 250ml Starbucks Frappucino Mocha 250ml Starbucks Double Shot 200ml Starbucks Discoveries Latte 220ml Yazoo Chocolate Caramel PM £1.15 400ml Yazoo Milk Chocolate PM £1.15 400ml Yazoo Milk Strawberry PM £1.15 400ml Yazoo Milk Banana PM £1.15 400ml Yazoo Milk Vanilla PM £1.15 400ml Yazoo Milk Banana PM £1.79 1ltr

Yazoo Milk Chocolate PM £1.79 1ltr Yazoo Milk Strawberry PM £1.79 1ltr Delamere Chocolate Milk 500ml Delamere Strawberry Milk 500ml Mars Drink PM £1.69 702ml Mars PM £1.29350ml Galaxy PM £1.29 350ml Vita Coco Natural Coco Water 1ltr Vita Coco 100% Pure Coconut Water 330ml

Naked Green Machine Juice Smoothie 300ml Naked Blue Machine Juice Smoothie 300ml Naked Mango Machine Juice Smoothie 300ml Tropicana Orange Juice Smooth PM £1 £1 250ml Tropicana Orange Juice Original PM £1.25 250ml Tropicana Original PM £2.75 850ml Tropicana Smooth PM £2.75 850ml Best-one Orange Juice 2 For £2 1ltr Best-one Apple Juice PM 2 For £2 1ltr

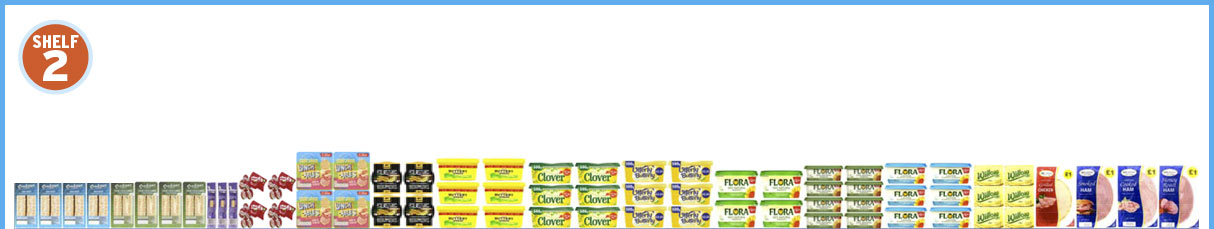

Snacksters Tuna Mayo 147g Snacksters Cheese & Onion 147g Cheesestrings PM 45p 20g Mini Babybel Original 120g

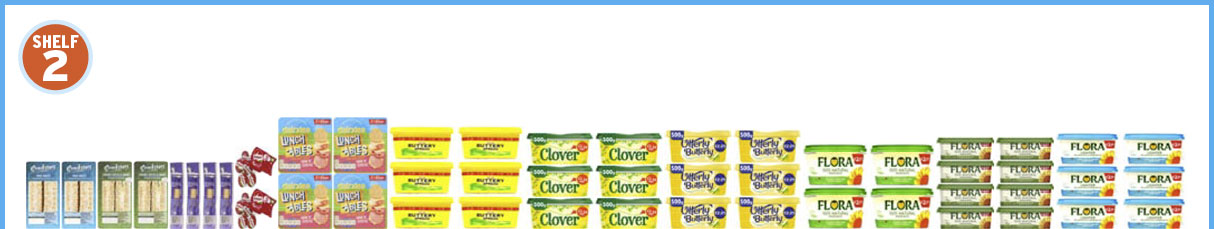

Lunchables Ham Cheese PM £1.65 74.1g Best-one Buttery 450g PM £1.25 450g Clover PM £2.59 500g Utterly Butterly PM £2.25 500g

Flora Original PM £2.50 450g Flora Original PM £1.50 250g Flora Light PM £2.50 450g

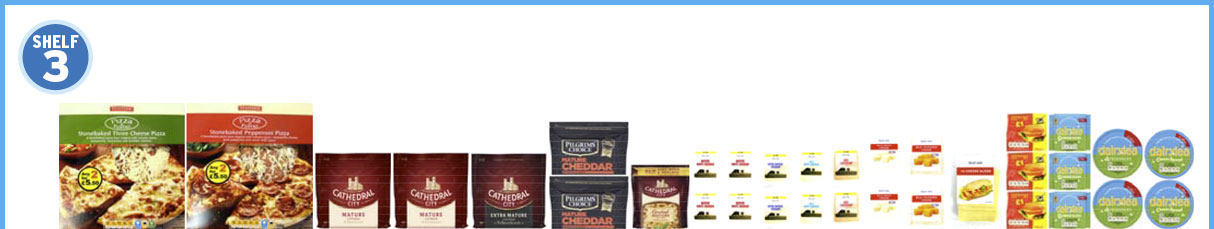

Alforno 3 Cheese Pizza 331g Alforno Pepperoni Pizza 330g Cathedral City Mature 200g Cathedral City Extra Mature 200g Pilgrims Mature 350g Cathedral City Grated Mature Cheddar 180g

Best-one Mature White Cheddar PM £1.99 200g Best-one Extra Mature Cheddar PM £1.99 200g Best-one Mild White Cheddar PM £1.99 200g Best-one Red Leicester PM £1.99 200g Best-one Mild White Cheddar PM £1.29 150g Best-one Mild Coloured Cheddar PM £1.29 150g

Best-one Cheese Slices 200g Country Cow Processed Cheese Slice 200g Dairylea Slices PM £1.70 164g Dairylea Triangles PM £1.65 125g Dairylea Spread PM £1.65 145g

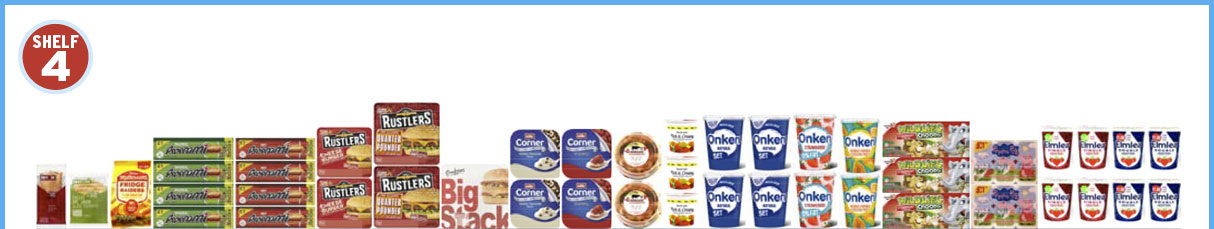

Snaz On The Go Sausage Roll PM £1.29 130g Snax On The Go Cheese & Onion Slice PM £1.29 150g Fridge Raiders Slow Cooked Roast Chicken Bites 60g Peperami PM £1 28g Peperami Hot PM £1 28g Rustlers Flame Grilled Cheeseburger PM £1.40 141g Rustlers Quarter Pounder £2.40 190g

Snacksters Big Snack 204g Muller Corner Vanilla & Chocolate 124g Muller Corner Strawberry 136g Nomadic Oat Clusters With Strawberry & Nat Yogur 187g Best-one Rich Creamy Yoghurt PM 55p 150g Onken Natural Set Bio Yogurt 500g

Onken Fat Free Strawberry 0% Fat 450g Onken Mango Papaya & Passionfruit 450g Wildlife Choobs Strawberry 6 Pack PM £1 6 X 37g Peppa Pig Strawberry Fromage Frais 6 Pack PM £1 45g Elmlea Single £1.60 270ml Elmlea Double £1.60 270ml

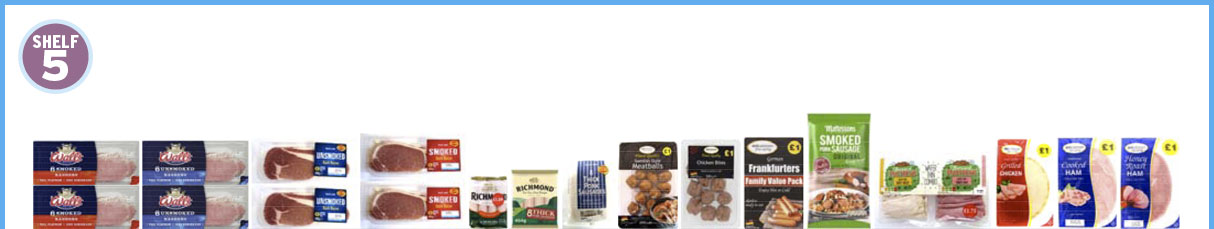

Walls Bacon Smoked 220g Walls Bacon Unsmoked 220g Best-one Unsmoked Back Bacon PM £1.79 200g Best-one Smoked Back Bacon PM £1.79 200g Richmond Skinless Sausages 213g

Richmond Thick Sausage PM £2.29 454g Best-one Thick Pork Sausages PM £2.25 400g Delicatessan Fine Eating Swedish Meatballs PM £1 200g Delicatessan Fine Eating Chicken Bites PM £1 200g Dfe Frankfurter 12s PM £1 240g

Mattessons Smoked Pork Sausage 200g Bernard Matthews Wafer Thin Turky & Ham 240g Delicatessen Sliced Roast Chicken 90g Dfe Cooked Ham PM £1 90g Dfe Honey Roast Ham PM £1 90g

We suggest you stock the following range:

Click shelf to hide/show shelf product list

Tropicana Orange Juice Smooth PM £1 250ml Tropicana Orange Juice Original PM £1.25 250ml Naked Green Machine Juice Smoothie 300ml Naked Blue Machine Juice Smoothie 300ml Naked Mango Machine Juice Smoothie 300ml Naked Juice Red Machine 300ml Vita Coco 100% Pure Coconut Water 330ml Copella Apple Juice PM £1 300ml Starbucks Frappucino Coffee 250ml Starbucks Frappucino Coffeemocha 250ml

Starbucks Double Shot 200ml Starbucks Double Shot No Added Sugar 200ml Starbucks Discoveries Caramel Macchiato 220ml Starbucks Discoveries Latte 220ml Caffe Latte Cappuccino 230ml Yazoo Milk Chocolate PM £1.15 400ml Yazoo Milk Banana PM £1.15 400ml Yazoo Milk Strawberry PM £1.15 400ml Yazoo Milk Vanilla PM £1.15 400ml Mars PM £1.29 350ml

Galaxy PM £1.29 350ml Malteser PM £1.29 350ml Milkyway PM £1.29 350ml Delicatessan Fine Eating Swedish Meatballs PM £1 200g Delicatessan Fine Eating Hot & Spicy Meatball PM £1 200g Delicatessan Fine Eating Chicken Bites PM £1 200g Delicatessen Fine Eating Tikka Bites PM £1 200g Dfe Frankfurter 12's PM £1 240g Mattessons Smoked Pork Sausage 200g Bernard Matthews Wafer Thin Turkey & Ham 280g

Snacksters Tuna Mayo 147g Snacksters Cheese & Onion 147g Cheesestrings PM 45 20g Mini Babybel Original 120g Lunchables Ham Cheese PM £1.65 74.1g Delphi Houmous Dip 170g

Best One Buttery 450g PM £1.25 450g Clover PM £2.59 500g Utterly Butterly PM £2.25 500g Flora Original PM £2.50 450g Flora Original PM £1.50 250g Flora Light PM £2.50 450g

Willow Blend Spread 250g Delicatessen Sliced Roast Chicken 90g Dfe Smoked Ham PM £1 90g Dfe Cooked Ham PM £1 90g Dfe Honey Roast Ham PM £1 90g

Snax On The Go Cheese & Onion Slice PM £1.29 150g Snax On The Go Chicken & Mushroom Slice PM £1.29 150g Snax On The Go Peppered Steak Slice PM £1.29 150g Snaz On The Go Sausage Roll PM £1.29 130g Cathedral City Mature 200g Cathedral City Extra Mature 200g Pilgrims Mature 350g

Best-one Mature White Cheddar PM £1.99 200g Best-one Extra Mature Cheddar PM £1.99 200g Best-one Mild White Cheddar PM £1.99 200g Best-one Red Leicester PM £1.99 200g Best-one Mild Coloured Cheddar PM £1.29 150g Best-one Cheese Slices 200g

Best-one Mature Cheddar Slices 200g Cathedral City Grated Mature Cheddar 180g Country Cow Processed Cheese Slices 200g Dairylea Slices PM £1.70 164g Dairylea Triangles PM £1.65 125g Dairylea Spread PM £1.65 145g

Peperami PM £1 28g Peperami Hot PM £1 28g Peperami Firestick PM £1 28g Fridge Raiders Slow Cooked Roast Chicken Bites 60g Fridge Raiders Southern Style Chicken Bites 60g Rustlers Flame Grilled Cheeseburger PM £1.40 141g Rustlers Quarter Pounder £2.40 190g Rustlers Southern Fried Chicken Burger PM £1.40 145g

Rustlers BBQ Rib PM PM £2.30 157g Snacksters Big Snack 204g Muller Corner Vanilla & Chocolate 124g Muller Corner Strawberry 136g Nomadic Oat Clusters With Strawberry & Nat Yogurt 187g Best-one Rich Creamy Yoghurt PM 55p 150g Onken Natural Set Bio Yogurt 500g

Onken Fat Free Strawberry 0% Fat 450g Onken Mango Papaya & Passionfruit 450g Wildlife Choobs Strawberry 6 Pack PM £1 6 X 37g Peppa Pig Strawberry Fromage Frais 6 Pack PM £1 Elmlea Single £1.60 270ml Elmlea Double £1.60 270ml Cuisine Real Dairy Cream UHT Aerosol Cream 500g

Walls Bacon Smoked 220g Walls Bacon Unsmoked 220g Best-one Unsmoked Back Bacon PM £1.79 200g Best-one Essentials Unsmoked Back Bacon PM 99p 150g Best-one Smoked Back Bacon PM £1.79 200g Richmond Skinless Sausages 213g Best-one 14 Pork Chipolatas PM £1.99 400g

Richmond Thick Sausage 8's 410g Best-one Thick Pork Sausages PM £2.25 400g Tropicana Original PM £2.75 850ml Tropicana Smooth PM £2.75 850ml Vita Coco Natural Coco Water 1ltr Yazoo Milk Banana PM £1.79 1ltr

Yazoo Milk Strawberry PM £1.79 1ltr Yazoo Milk Chocolate PM £1.79 1ltr Mars Chocolate Milkshake PM £1.99 702ml Fresh Life Milk Semi Skimmed 1ltr Fresh Life Milk Semi Skimmed 2ltr Cravendale Semi Skimmed Milk 2ltr

Alforno 3 Cheese Pizza 331g Alforno Pepperoni Pizza 330g Bistro Express Butter Chicken 400g Butter Express Chicken Tikka Masala 400g Bistro Express Spaghetti Bolognese 400g

Bistro Express Sweet And Sour Chicken 400g Alpro Original UHT 1ltr Alpro Almond Original 1ltr Alpro Almond Unsweetend 1ltr

Fresh Life Milk Whole 500ml Fresh Life Milk Semi Skimmed 500ml Fresh Life Milk Whole 1ltr Fresh Life Milk Whole 2ltr

We suggest you stock the following range:

Click shelf to hide/show shelf product list

Tropicana Orange Juice Smooth PM £1.25 250ml Tropicana Orange Juice Original PM £1.25 250ml Tropicana Multivitamins PM £1.25 250ml Naked Green Machine Juice Smoothie 300ml Naked Blue Machine Juice Smoothie 300ml Tropicana Nkd Gold Machine 300ml Tropicana Nkd Ruby Machine 300ml Vita Coco 100% Pure Coconut Water 330ml Copella Apple Juice PM £1 300ml Starbucks Frappucino Coffee 250ml Starbucks Frappucino Coffee Mocha 250ml Starbucks Double Shot 200ml

Starbucks Double Shot No Added Sugar 200ml Starbucks Discoveries Caramel Macchiato 220ml Starbucks Discoveries Latte 220ml Caffe Latte Cappuccino 250ml Yazoo Chocolate Milk PM £1.29 2 For £2 400ml Yazoo Banana Milk PM £1.29 400ml Yazoo Strawberry Milk PM £1.29 400ml Yazoo Milk Vanilla PM £1.15 400ml Mars Choc Milk PM £1.49 350ml Mars Caramel Milk PM £1.49 350ml Galaxy Choc Milk PM £1.49 350ml Bounty Choc Milk PM £1.49 350ml

Malteser Choc Ms PM £1.49 350ml Milkyway Choc Milk PM £1.49 350ml Snickers Choc Milk PM £1.49 350ml Delicatessan Fine Eating Swedish Meatballs PM £1 200g Delicatessan Fine Eating Hot & Spicy Meatball PM £1 200g Delicatessan Fine Eating Chicken Bites PM £1 200g Delicatessen Fine Eating Tikka Bites PM £1 200g Dfe Frankfurter 12's PM £1 240g Mattessons Smoked Pork Sausage 200g Bernard Matthews Chicken Breast Slices 80g Bernard Matthews Wafer Thin Turkey Ham 100g Bernard Matthews Wafer Thin Turky & Ham 280g

Snacksters Tuna Mayo 147g Snacksters Cheese & Onion 147g Snacksters Chicken & Bacon Mayo 147g Snacksters Chicken Tikka 147g Snacksters Egg Mayo 147g Cheesestrings PM 45p 20g Dairylea Dunker Jumbo PM 69p 41g Dairylea Dunkers Bread Stick PM 69p 43g Dairylea Dunkers Ritz PM 69p 43g Mini Babybel Original 120g Lunchables Ham Cheese PM £1.65 74.1g

Dairylea Lunchables Chicken PM £1.65 68.3g A.a.s Ham PM £1.50 86g Delphi Houmous Dip 170g Best-one Buttery 450g PM £1.25 Clover PM £2.59 500g Clover PM £2 500g I Cant Believe Its Not Butter PM £1.20 250g Utterly Butterly PM £2.25 500g Flora Original PM £2.50 450g Flora Original PM £1.50 250g Flora Light PM £2.50 450g

Flora Light PM £1.50 250g Lurpak Spreadable 250g Lurpak Lighter Spread 250g Willow Blend Spread 250g Kerrygold Butter PM £2.39 200g Anchor Butter 20's 250g Delicatessen Sliced Roast Chicken 90g Mattessons Cooked Ham PM £2 250g Dfe Smoked Ham PM £1 90g Dfe Cooked Ham PM £1 90g Dfe Honey Roast Ham PM £1 90g

Snax On The Go Cheese & Onion Slice PM £1.29 150g Snax On The Go Chicken & Mushroom Slice PM £1.29 150g Snax On The Go Peppered Steak Slice PM £1.29 150g Snaz On The Go Sausage Roll PM £1.29 130g Cathedral City Mature 200g Cathedral City Extra Mature 200g Pilgrims Mature 350g Best-one Mature White Cheddar PM £1.99 200g

Best-one Mature Coloured Cheddar PM £1.99 200g Best-one Extra Mature Cheddar PM £1.99 200g Best-one Mild White Cheddar PM £1.99 200g Best-one Red Leicester PM £1.99 200g Best-one Mild White Cheddar PM £1.29 150g Best-one Mild Coloured Cheddar PM £1.29 150g Desi Paneer 226g

Best-one Cheese Slices 200g Best-one Mature Cheddar Slices 200g Cathedral City Grated Mature Cheddar 180g Country Cow Processed Cheese Slices 200g Dairylea Slices PM £1.70 164g Dairylea Triangles PM £1.65 125g Dairylea Spread PM £1.65 145g

Peperami PM £1 28g Peperami Hot PM £1 28g Peperami Firestick PM £1 28g Fridge Raiders Slow Cooked Roast Chicken Bites 60g Fridge Raiders Southern Style Chicken Bites 60g Rustlers Flame Grilled Cheeseburger PM £1.40 141g Rustlers Quarter Pounder £2.40 190g Rustlers Deluxe £2.40191g Rustlers Southern Fried Chicken Burger PM £1.40 145g Rustlers Sausage Muffin PM £1.85 177g

Rustlers BBQ Rib PM £2.30 157g Snacksters Big Snack 204g Muller Corner Vanilla & Chocolate 124g Muller Corner Strawberry 136g Golden Acre Vff Yogurt 100g Golden Acre Chocolate Dessert 4 Pack 125g Nomadic Oat Clusters With Strawberry & Nat Yogurt 187g Nomadic Oat Clusters With Chocolate & Nat Yogurt 169g Bestone Rich Creamy Yoghurt PM 55p 150g Onken Natural Set Bio Yogurt 500g

Onken Natural Set 1kg Onken Fat Free Strawberry 0% Fat 450g Onken Mango Papaya & Passionfruit 450g Wildlife Choobs Strawberry 6 Pack PM £1 6 X 37g Peppa Pig Strawberry Fromage Frais 6 Pack PM £1 45g Elmlea Single £1.60 270ml Elmlea Double £1.60 270ml Elmlea Aerosol 250g Cuisine Real Dairy Cream UHT Aerosol Cream 500g

Walls Bacon Smoked 220g Walls Bacon Unsmoked 220g Best-one Unsmoked Back Bacon PM £1.79 200g Best-one Essentials Unsmoked Back Bacon PM 99p 150g Best-one Smoked Back Bacon PM £1.79 200g Richmond Skinless Sausages 213g Best-one 14 Pork Chipolatas PM £1.99 400g Richmond Thick Sausage 8's 410g

Best-one Thick Pork Sausages PM £2.25 400g Tropicana Original PM £2.75 850ml Tropicana Smooth PM £2.75 850ml Tropicana Orange & Mango PM £2.75 850ml Vita Coco Natural Coco Water 1ltr Yazoo Milk Banana PM £1.99 1ltr Yazoo Milk Strawberry PM £1.99 1ltr

Yazoo Milk Chocolate PM £1.99 1ltr Mars Chocolate Milkshake PM £1.99 702ml Dairy Pride UHT Semi Skimmed Milk 500ml Fresh Life Milk Semi Skimmed 1ltr Fresh Life Milk Semi Skimmed 2ltr Cravendale Semi Skimmed Milk 2ltr Cravendale Whole Milk 2ltr

Alforno 3 Cheese Pizza 331g Alforno Pepperoni Pizza 330g Bistro Express Butter Chicken 400g Butter Express Chicken Tikka Masala 400g Bistro Express Spaghetti Bolognese 400g

Bistro Express Sweet And Sour Chicken 400g Alpro Original UHT 1ltr Alpro Soya Unsweetened UHT 1ltr Alpro Almond Original 1ltr Alpro Almond Unsweetend 1ltr

Alpro Coconut Original 1ltr Fresh Life Milk Whole 500ml Fresh Life Milk Semi Skimmed 500ml Fresh Life Milk Whole 1ltr Fresh Life Milk Whole 2ltr

We suggest you stock the following range:

Click shelf to hide/show shelf product list

Tropicana Orange Juice Smooth PM £1.25 250ml Tropicana Orange Juice Original PM £1.25 250ml Tropicana Multivitamins PM £1.25 250ml Naked Green Machine Juice Smoothie 300ml Naked Blue Machine Juice Smoothie 300ml Tropicana Nkd Gold Machine 300ml Tropicana Nkd Ruby Machine 300ml Vita Coco 100% Pure Coconut Wate 330ml Copella Apple Juice PM £1 300ml Starbucks Frappucino Coffee 250ml Starbucks Frappucino Coffee Mocha 250ml Starbucks Double Shot 200ml Starbucks Double Shot No Added Sugar 200ml Starbucks Discoveries Caramel Macchiato 220ml

Starbucks Discoveries Latte 220ml Caffe Latte Cappuccino 250ml Caffe Latte Light 230ml Yazoo Chocolate Milk PM £1.29 2 For £2 400ml Yazoo Banana Milk PM £1.29 400ml Yazoo Strawberry Milk PM £1.29 400ml Yazoo Milk Vanilla PM £1.15 400ml Mars Chocolate Milk PM £1.49 350ml Mars Caramel Milk PM £1.49 350ml Galaxy Chocolate Milk PM £1.49 350ml Bounty Chocolate Milk £1.49 350ml Malteser Chocolate Milk £1.49 350ml Milkyway Chocolate Milk £1.49 350ml

Snickers Chocolate Milk £1.49 350ml Delicatessan Fine Eating Swedish Meatballs PM £1 200g Delicatessan Fine Eating Hot & Spicy Meatball PM £1 200g Delicatessan Fine Eating Chicken Bites PM £1 200g Delicatessen Fine Eating Tikka Bites PM £1 200g Dfe Frankfurters 12's PM £1 240g Mattessons Smoked Pork Sausage 200g Bernard Matthews Chicken Breast Slices 80g Bernard Matthews Sliced Turkey Breast 80g Bernard Matthews Wafer Thin Turkey 100g Bernard Matthews Tikka Turkey Breast Chunks 80g Bernard Matthews Wafer Thin Turkey Ham 100g Bernard Matthews Wafer Thin Turky & Ham 280g

Snacksters Tuna Mayo 147g Snacksters Cheese & Onion 147g Snacksters Chicken & Bacon Mayo 147g Snacksters Chicken Tikka 147g Snacksters Egg Mayo 147g Cheesestrings PM 45p 20g Dairylea Dunker Jumbo PM 69p 41g Dairylea Dunkers Bread Stick PM 69p 43g Dairylea Dunkers Ritz PM 69p 43g Mini Babybel Original 120g Lunchables Ham Cheese PM £1.65 74.1g Dairylea Lunchables Chicken PM £1.65 68.3g A.a.s Ham PM £1.50 86g

Delphi Houmous Dip 170g Elsinore Cockles In Vinegar 200g Elsinore Mussels In Vinegar 200g Stork Sb 250g Best One Buttery 450g PM £1.25 450g Clover PM £2.59 500g I Cant Believe Its Not Butter PM £1.20 250g Utterly Butterly PM £2.25 500g Utterly Butterly PM £1.19 250g Flora Original PM £2.50 450g Flora Original PM £1.50 250g Flora Light PM £2.50 450g Flora Light PM £1.50 250g

Lurpak Spreadable 250g Lurpak Lighter Spread 250g Lurpak Slightly Salted 250g Willow 250g Kerrygold Butter PM £2.39 200g Anchor Butter 250g Anchor Spreadable 250g Delicatessen Sliced Roast Chicken 90g Mattessons Cooked Ham PM £2 250g Dfe Smoked Ham PM £1 90g Dfe Cooked Ham PM £1 90g Dfe Honey Roast Ham PM £1 90g Dfe Honey Roast Ham PM £1 90g

Snax On The Go Cheese & Onion Slice PM £1.29 150g Snax On The Go Chicken & Mushroom Slice PM £1.29 150g Snax On The Go Peppered Steak Slice PM £1.29 150g Snaz On The Go Sausage Roll PM £1.29 130g Cathedral City Mature 200g Cathedral City Extra Mature 200g Pilgrims Mature 350g Best-one Mature White Cheddar PM £1.99 200g Bestone Mature Coloured Cheddar PM £1.99 200g Bestone Extra Mature Cheddar PM £1.99 200g

Bestone Mild White Cheddar PM £1.99 200g Bestone Red Leicester PM £1.99 200g Bestone Mild White Cheddar PM £1.29 150g Bestone Mild Coloured Cheddar PM £1.29 150g Bestone Vegetarian Cheddar PM £1.99 200g Desi Paneer 226g Meraki Halloumi 250g Galbani Parmigiano Wedge 200g Select Long Life Brie 125g Select Long Life Camembert 125g

Discover Mozzarella 200g . Leerdammer Original 160g Cathedral City Grated Mature Cheddar 180g Best-one Ess Cheese Slices 200g Best-one Mature Cheddar Slices 200g Country Cow Processed Cheese Slice 200g Dairylea Slices PM £1.70 164g Dairylea Triangles PM £1.65 125g Dairylea Spread PM £1.65 145g

Peperami PM £1 28g Peperami Hot PM £1 28g Peperami Firestick PM £1 28g Fridge Raiders Slow Cooked Roast Chicken Bites 60g Fridge Raiders Southern Style Chicken Bites P/M 60g Rustlers Flame Grilled Cheeseburger PM £1.40 141g Rustlers Quarter Pounder £2.40 190g Rustlers Deluxe £2.40 191g Rustlers Southern Fried Chicken Burger PM £1.40 145g Rustlers Sausage Muffin PM £1.85 177g Rustlers BBQ Rib PM £2.30 157g

Snacksters Big Snack 204g Muller Corner Vanilla & Chocolate 124g Muller Corner Strawberry 136g Golden Acre Vff Yogurt 100g Golden Acre Chocolate Dessert 4 Pack 125g Nomadic Oat Clusters With Strawberry & Nat Yogurt 187g Nomadic Oat Clusters With Chocolate & Nat Yogurt 169g Bestone Rich Creamy Yoghurt PM 55p 150g Onken Natural Set Bio Yogurt 500g Onken Natural Set 1kg

Onken Fat Free Strawberry 0% Fat 450g Onken Mango Papaya & Passionfruit 450g Yop Strawberry Yogurt Drink 500g Yop Raspberry Yogurt Drink 500g Wildlife Choobs Strawberry 6 Pack PM £1 6 X 37g Peppa Pig Strawberry Fromage Frais PM £1 6 Pack Elmlea Single PM £1.60 270ml Elmlea Double PM £1.60 270ml Elmlea Aerosol 250g Cuisine Real Dairy Cream UHT Aerosol Cream 500g

Walls Bacon Smoked 220g Danish Sizzle Smoked Rindless Back Bacon 250g Walls Bacon Unsmoked 220g Danish Sizzling Unsmoked Back Bacon 250g Danish Rindless Back Bacon 400g Best-one Unsmoked Back Bacon PM £1.79 200g Best-one Smoked Back Bacon PM £1.79 200g Best-one Essentials Unsmoked Back Bacon PM 99p 150g Richmond Skinless Sausages 213g

Best-one 14 Pork Chipolatas PM £1.99 400g Richmond Thick Sausage 8's 410g Best One Thick Pork Sausages PM £2.25 400g Tropicana Original PM £2.75 850ml Tropicana Smooth PM £2.75 850ml Tropicana Orange & Mango PM £2.75 850ml Vita Coco Natural Coco Water 1ltr Copella Apple Juice PM £2.50 900ml Yazoo Milk Banana PM £1.99 1ltr

Yazoo Milk Strawberry PM £1.99 1ltr Yazoo Milk Chocolate PM £1.99 1ltr Mars Chocolate Milkshake PM £1.99 702ml Dairy Pride UHT Semi Skimmed Milk 500ml Scot Pride Semi Milk 1ltr Fresh Life Milk Semi Skimmed 1ltr Fresh Life Milk Semi Skimmed 2ltr Cravendale Semi Skimmed Milk 2ltr Cravendale Whole Milk 2ltr

Alforno 3 Cheese Pizza331g Alforno Pepperoni Pizza 330g Bistro Express Butter Chicken 400g Butter Express ChickEn Tikka Masala 400g Bistro Express Spaghetti Bolognese 400g

Bistro Express Sweet And Sour Chicken 400g Alpro Original UHT 1ltr Alpro Soya Unsweetened UHT 1ltr Alpro Almond Original 1ltr Alpro Almond Unsweetend 1ltr

Alpro Coconut Original 1ltr Fresh Life Milk Whole 500ml Fresh Life Milk Semi Skimmed 500ml Fresh Life Milk Whole 1ltr Fresh Life Milk Whole 2ltr

View previous

View next